Posts

A citizen alien is somebody who is not a citizen otherwise federal of the All of us and you can whom match sometimes the new eco-friendly cards try or the generous presence sample for the schedule 12 months. A good WP otherwise WT which is a keen FFI (aside from a retirement money) also needs to join the brand new Internal revenue service at the Irs.gov/Businesses/Corporations/FATCA-Foreign-Financial-Institution-Registration-System to locate its relevant part cuatro position and you will GIIN. In case your overseas distributable show of money has efficiently linked money (ECI), find Connection Withholding to your ECTI, afterwards. There is the directly to terminate your plan, however you is to speak to your landlord observe if you have to look after accountability insurance rates because the a disorder out of their rent. The usa government method actually says it does prioritise diversity thanks to nutrient shelter partnerships aiming to present a far more secure and you can durable likewise have strings. As the You has many of the same critical minerals because the Ukraine, it offers usually outsourcing exploration and polishing due to ecological legislation, higher work will cost you and a lot more glamorous overseas areas.

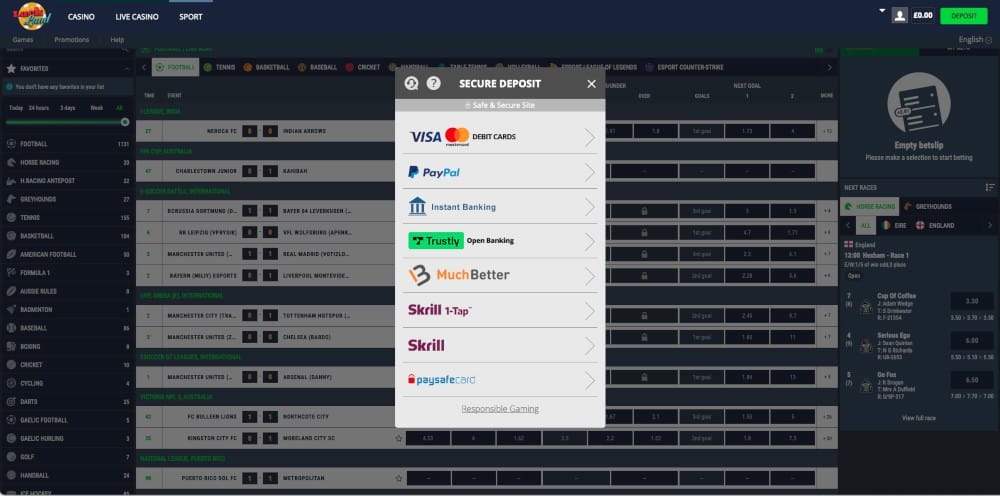

Online casino paypal | Barclays Unit Transfer Mortgages

That individual must document a U.S. tax get back and attach the brand new stamped Form 8288-A to discovered borrowing for your income tax withheld. A distribution because of the an excellent QIE to help you an excellent nonresident alien or foreign corporation that’s addressed because the gain in the sales otherwise exchange out of a good USRPI from the stockholder are subject to withholding from the 21%. The connection need to withhold to your whole amount of for every shipment designed to the new transferee until it might rely on a certification regarding the transferee one to says you to definitely an exemption to withholding enforce otherwise that give everything needed to dictate extent required becoming withheld. The partnership could possibly get rely on it degree to determine the withholding obligations regardless of whether it’s considering inside go out prescribed within the Legislation point step 1.1446(f)-2(d)(2). While the relationship gets a certification regarding the transferee, the relationship must withhold ten% of the matter knew for the transfer, quicker by any matter currently withheld by transferee, as well as people determined interest.

Tax Planning and you will Tax Laws to have NRIs Back to India

If that day try pursuing the before of your deadline (as well as extensions) to possess filing the newest WP’s Form 1042-S or perhaps the date the brand new WP in reality points Mode 1042-S to your calendar year, the newest WP could possibly get keep back and you can declaration people alterations necessary for fixing every piece of information for the following twelve months. The brand new the amount to which you’ll want withholding rates pond advice utilizes the brand new withholding and revealing personal debt assumed from the QI. You could rely on documentary evidence made available to you by the a keen NQI or a flow-because of entity using its Function W-8IMY. Which rule is applicable even though you make the fee in order to an enthusiastic NQI otherwise disperse-as a result of entity in the us. Usually, the brand new NQI otherwise move-due to entity that provides you documentary proof will also have so you can make you a good withholding statement, discussed later.

Such, you need to report earnings paid back in order to a different mediator or disperse-thanks to organization you to definitely accumulates to have a U.S. person at the mercy of Form 1099 reporting. Yet not, you may not be required to report on Setting 1099 if the you will be making a fees in order to a great performing FFI or joined considered-compliant FFI that provides a good withholding report allocating the newest commission so you can a section cuatro withholding price pond from You.S. payees. In addition to see Area S. Special Laws and regulations to have Reporting Payments Produced Because of International Intermediaries and International Flow-Because of Entities for the Function 1099 from the General Tips without a doubt Suggestions Productivity. But not, in the event the a foreign company is a different individual basis, it is at the mercy of an excellent 4% withholding tax to the all You.S. supply investment money. For a foreign taxation-exempt organization to claim an exemption of withholding under chapter 3 or 4 for its income tax-exempt status lower than section 501(c), or perhaps to allege withholding during the an excellent cuatro% rates, it should offer you a type W-8EXP. However, when the a different organization is claiming an exclusion from withholding lower than a tax treaty, or the earnings is actually unrelated organization nonexempt income, the company ought to provide a questionnaire W-8BEN-Age otherwise W-8ECI.

(8) A resident’s take action of your right to refuse transfer does not affect the online casino paypal resident’s qualification or entitlement so you can Medicare otherwise Medicaid benefits. (5) The right to display an area together with otherwise her roommate preference when practicable, when each other citizens live in the same studio and you will one another residents consent to the newest plan. (4) The ability to show a bedroom with his or the girl companion when hitched citizens inhabit a comparable business and you can one another spouses agree to the brand new arrangement. (5) Should your citizen subsequently picks another attending medical practitioner whom matches the newest standards specified inside part, the fresh studio need to award you to definitely options.

A resident alien paying rates of interest for the a great margin membership was able that have a different brokerage firm need to withhold in the desire whether the attention are repaid in person otherwise constructively. The source of retirement repayments depends on the newest section of the new distribution one to constitutes the brand new payment ability (boss benefits) and also the region one constitutes the gains feature (the fresh investment income). If the features are carried out partially in america and partially outside of the Us by a member of staff, the new allotment away from pay, besides certain fringe advantages, is set for the a period basis. The next perimeter pros are acquired for the a geographic base since the shown regarding the pursuing the listing. You may also, however, have confidence in a questionnaire W-8 since the installing the brand new membership holder’s overseas position if any out of another use.

The new election is done by indeed reducing the level of withholding at that time the new shipment is paid. Interest paid off so you can a controlled international company from a man relevant to the regulated international firm isn’t profile focus. The guidelines to own determining whether or not interest try profile interest altered to possess loans given after March 18, 2012. Before February 19, 2012, portfolio attention incorporated desire to the certain entered and you will nonregistered (bearer) ties in case your financial obligation meet the requirements described lower than. Certain focus try susceptible to a reduced speed of, otherwise exemption out of, withholding. You will find a new rule deciding if or not earnings away from ties try effortlessly related to the brand new active run of a great U.S. financial, funding, or equivalent organization.

A transferee are people, foreign or domestic, you to definitely acquires an excellent USRPI by get, exchange, present, or any other import. An amount knew regarding the sales out of an excellent PTP attention try the amount of gross continues paid back or paid regarding the selling. In the case of a good PTP distribution, an expense understood for the delivery is limited so you can an amount described inside the Laws point 1.1446(f)-4(c)(2)(iii). Partnership’s specifications so you can keep back under point 1446(f)(4) to your withdrawals to help you transferee.

Financial Difficulties: Just how An enthusiastic Unarranged Overdraft Can impact Their Mortgage App.

A payment is not experienced unexpected entirely because the number of the newest payment isn’t repaired. Use this category to report You.S. origin FDAP earnings that isn’t reportable lower than some of the other earnings groups. Examples of earnings which are reportable less than this category try earnings, insurance continues, patronage distributions, awards, and you will race wallets. A shielded expatriate must have offered you which have Function W-8CE alerting your of its secure expatriate status plus the fact that they can be at the mercy of unique tax laws and regulations relating to specific issues. If the complete spend is more than $3,100000, the complete amount try earnings from source in the usa which is subject to U.S. income tax. Just the employer will pay that it income tax; this is simply not subtracted from the employee’s earnings.

Income will be FDAP money whether it’s paid-in a great number of regular money or in one lump sum. Including, $5,000 in the royalty income will be FDAP income whether or not paid-in ten repayments of $five-hundred per or perhaps in you to definitely commission of $5,100000. The earnings part of a retirement fee is actually U.S. source earnings in case your believe is actually a good U.S. believe.

Which guide is actually for withholding agents whom spend earnings to help you overseas people, along with nonresident aliens, foreign organizations, foreign partnerships, overseas trusts, international properties, overseas governments, and around the world groups. Particularly, it means the brand new individuals guilty of withholding (withholding agencies), the sorts of income susceptible to withholding, and the guidance come back and you can tax go back processing debt of withholding representatives. Another Form 1042-S is needed per recipient of money so you can whom you generated payments inside the before calendar year regardless of whether your withheld or had been required to withhold income tax.

A surplus amount ‘s the amount of tax and you may desire withheld one is higher than the newest transferee’s withholding tax responsibility in addition to any interest owed because of the transferee when it comes to such as liability. The fresh transferee can also be accountable for any relevant charges or improvements to income tax. An excellent transferee must complete Area V from Setting 8288 and you will mount Form(s) 8288-C it acquired regarding the union when making a claim to own reimburse away from part 1446(f)(4) withholding. If a great transferee who may have not even accomplished and you may filed Region III out of Mode 8288 when it comes to an exchange and that is now saying a refund to possess quantity withheld lower than point 1446(f)(4), the fresh transferee must over Part III when submitting Region V out of Setting 8288. A collaboration that is required to keep back below Legislation part step one.1446(f)-3(a)(1) may not account for any modifications tips that would otherwise impact the matter required to getting withheld lower than Legislation point step 1.1446(f)-2(c)(2)(i).

Amidst the fresh great number of possibilities for NRI Financing in the India, the benefits of FCNR Deposit goes undetected. In this article, we will speak about the benefits of the new FCNR Put to have NRIs and you may know how it is advisable than simply the money options available comparing they for the likes out of NRE FD. (f) No punishment to possess untimely withdrawal will be levied, where depositors of one’s part as stated inside the area cuatro(h) of this guidance wishes premature withdrawal out of deposit following for the transfer out of business to some other financial. (c) In the eventuality of breaking of the number of name deposit from the the brand new demand from the claimant/s, zero penalty to own untimely detachment of one’s term deposit is going to be levied in case your several months and you will aggregate number of the brand new deposit manage perhaps not go through one changes. (h) The new At once Solution Site Rate2 to the respective currency / Exchange prices cited/displayed by Economic Benchmarks Asia Pvt. Ltd. (FBIL) is going to be put since the resource to own going to the interest costs on the FCNR(B) dumps.

The fresh resident features a directly to private confidentiality and you will privacy from their unique personal and you will scientific information. (ii) Where transform are made to charges for other stuff and features your business offers, the fresh business need to update the newest resident written down at the least 60 months just before implementation of the change. (ii) Modify for each and every Medicaid-qualified resident when transform are made to those things and you can services given inside the § 483.10(g)(17)(i)(A) and you may (B) of this area. (16) The fresh business must provide a notice out of liberties and functions so you can the fresh resident ahead of or on entry and you can inside resident’s remain. A business which is a compound type of region (as the laid out inside the § 483.5 need disclose in admission arrangement the physical setting, for instance the individuals locations where had been the brand new element line of area, and ought to establish the new formula one apply to place change ranging from its different locations below § 483.15(c)(9).